You’ll be able to get solar panel loans and finance in a few different ways:

For those not eligible for government grants, a home improvement loan is typically the most cost effective route to take.

With a range of rates available in the market, and a range of terms, it is best to do plenty of research before settling on a lender for solar.

You can make money each month, where there is excess electricity generation, via Smart Export Guarantee (SEG) payments. This can help to offset interest payments, but it all depends on the loan amount, tenure and interest rate, as well as the time of year for solar generation.

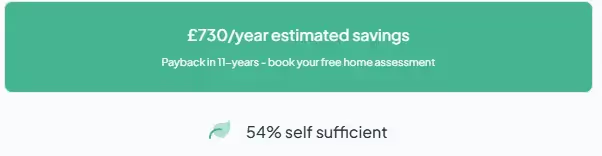

You’ can expect a payback period of around 11-13years (not including loan interest) for solar panels without a battery (according to Energy Saving Trust), but solar panels last over 25-years; plenty of years after you have recouped the initial outlay, even accounting for inflation.

If you don’t have the cash to purchase solar panels, a loan could be a good option thanks to:

Use our configuration tool here to determine what size system you need, and how much it’s going to cost.

If you’re not eligible for a government grant - which most households aren’t - a home improvement loan is typically the cheapest form of finance for solar panels. You can apply for home improvement loans via any high street bank.

But what will a solar panel loan cost?

First, we need to determine how much a suitable solar panel system is going to be.

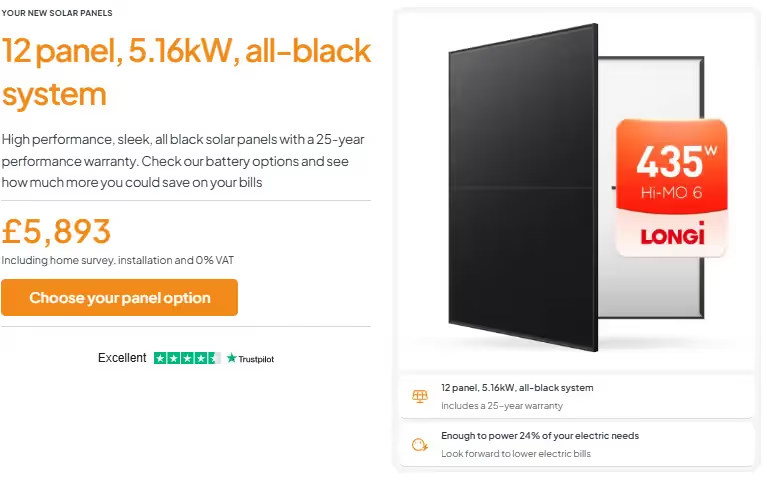

For a medium-high consumption household (4,000kWh+ of annual electricity consumption), you’d need something like this, a 5.16kW 12-panel system:

This is a system suited to 2-4 bedroom houses. For the sake of this example, we’ve not clicked on the option for a solar storage battery. This means the overall installation cost is minimal; £5,893 including professional installation by a MCS certified engineer.

You can check the exact cost of your system using our clickable solar panel tool here. And you’ll also be able to toggle between different battery options to see what works best for your property in terms of self-sufficiency and electricity bill savings.

As a rule of thumb, the longer the loan repayment, the higher the APR. However, you can set up your solar panel loan so that essentially, your electricity bill savings and Smart Export Guarantee (SEG) income pay for it.

A typical high street bank’s home improvement loan sits at around 8.2% over a 10-year period, and the figures would look like this:

The big advantage here, is that by using a solar panel loan to fit a system, here’s what you could save:

A combination of SEG payments (£397 a year on average) and electricity bill savings (£235 per year) means you’ll save around £632 per annum; £52.67 per month.

This means that the net cost of your solar panel system would be approximately £18.54 per month, in this scenario, by using a home improvement loan as your method of finance. Please note that this is only an illustrative example and rates and repayments could well be higher and solar generation might be lower.

Microgeneration Certification Scheme (MCS) installers are who you need to contact to have solar panels installed. If you don’t have your panels installed by an MCS registered installer, you won’t be eligible for both the 0% VAT scheme, nor SEG payments.

The government’s 0% VAT scheme on green energy products means you could save £100s on the above installation (£5,893 total cost). And as you can see, without being eligible for the SEG, you could lose out on £397 per year in export payments:

However, you don’t have to use installer’s finance packages. After browsing dozens of installer’s finance terms & conditions, we found that generally the terms are unfavourable.

You can expect:

When comparing the average installer’s solar panel finance package, a home improvement loan offers much better value.

To get an idea of the size loan you’d need for your solar panels, you can use our configuration tool here.

You’ll get fixed prices on-screen, and all of our installers are MCS registered; the price accounts for 0% VAT and you’ll be eligible for SEG payments.

Very few households are eligible for government funding or free solar panels via grants, but it's certainly worth checking before applying for a loan / finance and stumping up thousands of £s.

The most popular government grants for solar panels are:

In general, to receive any kind of government grant for solar panels, you'd need to fall into one or all of the categories below:

We’ve written a detailed guide to solar panel grants here, so you can determine if you might be eligible.

Don’t think you’re eligible? Use our clickable solar panel tool here to determine how much your system is going to cost.

Now you know the best type of finance for your situation, the next thing to consider is, what are the advantages of getting a loan for solar panel installation in the first place?

The biggest benefit of getting a solar panel loan for an installation, is that you might be able to come close to covering the interest repayments using SEG payments and what you save on monthly electricity bills (but this depends on a number of variable factors and cannot be considered a certainty by any stretch).

A typical property is going to:

The combination of energy bills savings and SEG income, means you’ll be paying roughly £20 per month (in the example above) for your solar panel system, even when accounting for home improvement loan interest. This, again, is an illustrative example and would not apply to every property.

When accounting for savings and SEG payments, expected payback period / return on investment would be less than 13 years (in many cases, but not all) according to the Energy Savings Trust.

This is going to leave you with over a decade of free electricity. As you can see from a LONGi solar panel review, solar panels generally last 25-40 years!

As a side note, this is an example setup for a medium-high consumption household; 4,545kWh electricity consumption per year. If your property consumes more / less electricity than this, the figures are going to change.

Our solar panel tool can determine the perfect system for your property, and you’ll see estimated electricity bill savings, as well as approximations for SEG income payments on-screen.

An overlooked advantage of getting solar panel finance and installing a green energy system, is self-sufficiency.

Electricity prices tend to trend one way…and that’s up.

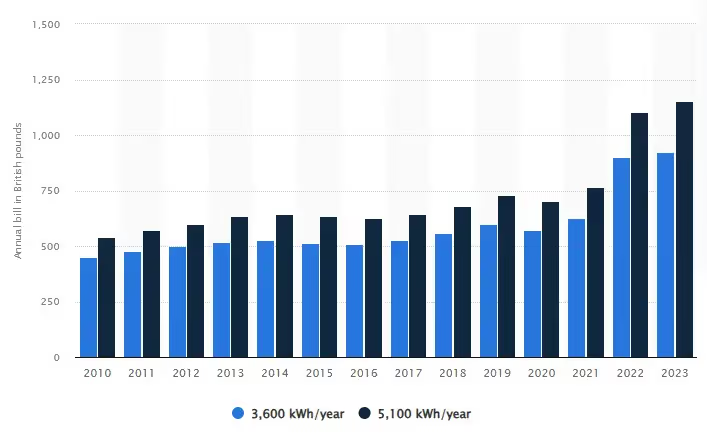

It’s not the case every year, especially with things like energy price caps in place. However, if we take a look at this chart from Statista, the overall trend is not in our favour…

The average UK electricity bill more than doubled over this 13-year period!

By using solar panels, you’ll protect yourself from these rising costs. And another benefit is that with rising costs, comes bigger savings. That’s going to reduce your payback period / ROI dramatically, even though the interest on your solar panel loan will stay the same.

Self-sufficiency levels will vary depending on if / which solar battery you choose to install. You can read more about solar storage batteries here.

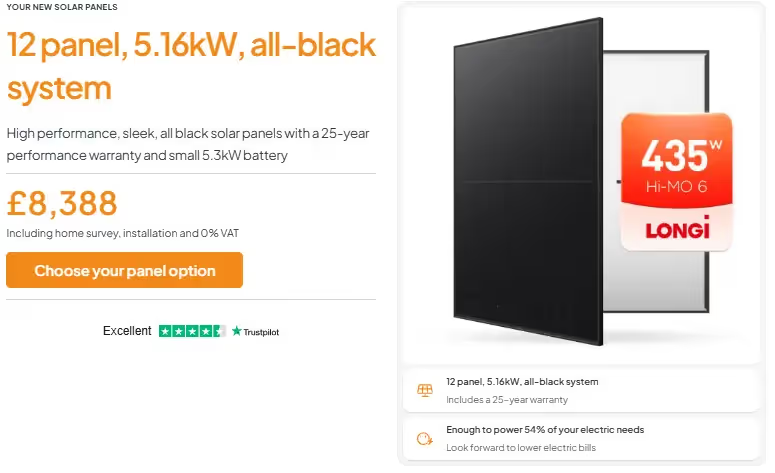

A system without a battery offers the best ROI. However, even by utilising a small solar battery, you’ll see your self-sufficiency jump from 24% to 54%, as well as increasing electricity bill savings.

You can use our clickable solar panel tool here, and see how our different battery options affect both self-sufficiency levels and energy bill savings.

Finally, another huge advantage of getting solar panels on finance, is the removal of a huge upfront cost. The system we mentioned above (5.16kW without a battery) costs £5,893 including installation.

However, even adding a small battery (advisable in order to get extra electricity bill savings and improve self-sufficiency), you’d be looking at a total outlay of £8,388.

Whilst you will pay some interest by using a solar panel loan, the majority of this loan repayment would be covered by SEG income and electricity bill savings.

Find out which system you need and exactly how much it’s going to cost by using our system configuration tool here. It includes a free online roof scan to ensure your system is suited to your property.

Try our free quote tool. You'll have your personalised quote in under a minute.